Hello dear Reader! 🙂

This section is for all my fellow number-panickers and Humanity-brains who are as out of their depth as I am with regards to the financial world and its vocabulary. It also includes Early Retirement vocabulary that is thrown around.

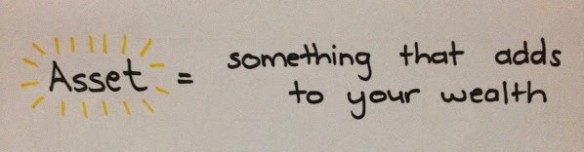

Asset

People typically invest in assets. Check out this post for more information about types of assets.

Bonds

You lend money (capital) for a specified amount of time and in return they: (a) pay you interest and (b) at the end of the specified time give you your capital back. It is a type of asset. Check out this post for more details.

Capital

Cash and Cash Equivalents (CCE)

Cash or anything that can be turned into cash immediately (for example, a money market account or a savings account). Check out this post for more details.

Compound Interest

Your interest earning interest. In other words, your money working for you without you doing a thing except giving it the gift of time. It’s AWESOME. Check out My Beginner’s Understanding of Investing- Part 4: My Portfolio Baby for more detail.

Debt Free

Having no debt (credit cards, personal loans, store accounts etc) except your house mortgage (at an acceptable interest rate). A house morgage is the only acceptable debt – and even that can be debated it seems.

Early Retirement

Simply put: retiring before the traditional age of 65 years old. Exactly the same as Financial Independence (from what I can gather!). See My (beginners!) understanding of Early Retirement for more detail.

Emergency Fund

A stockpile of money (most people seem to say about 3 months worth of your monthly expenses) that is easily/immediately accessible but ONLY in an emergency that would otherwise put you into debt.

Equities

This term had me stumped for ages! But all it is is: stocks/shares/the stock market i.e. a type of asset that you own. You are basically buying tiny, tiny pieces of a company and so becoming a part owner of that company. The term “high equity investment” (which often seems to get thrown around!) simply means an investment that consists of a lot of stocks/shares. Check out this post for more details. (P.S. Don’t confuse “equities” with “equity”. Equity seems to be a measure of wealth: assets minus liabilities…)

FI: Financial Independence

The point at which your investment returns are equal to your living expenses. In other words the interest earned on your investments will cover all your expenses and so you are no longer reliant on income from work. You are no longer financially dependent on work. You are free 🙂

FIRE: Financial Independence/Retire Early

See the explanations for “Early Retirement” and “FI” above.

Inflation

Investment

Either money or time that is put into something (a business, a house, the stock market etc) with the aim of gaining some kind of benefit. Check out this post for more details/context.

Liquidity

This seems to be is a measure of how quickly and easily something can be converted into cash. For example, Cash and Cash Equivalents (CCE) have a very high liquidity.

Portfolio

A person’s portfolio is the sum total of someone’s investments. It is often talked about in terms of what percentage of the portfolio is in which types of assets (typically: equities, bonds and cash). Check out My Beginner’s Understanding of Investing- Part 4: My Portfolio Baby for more detail.

Real/Real Return

SWR: Safe Withdrawal Rate

The percentage you can withdraw from your investment or capital each year that ensures that your investment or capital will never run out. See My (beginners!) understanding of Early Retirement and We have a problem: I’m not American. Part 3. for more detail.